Electrolysers are in the news nowadays, pulled out of industrial obscurity by the new Green Hydrogen rush. So SaurEnergy explains gets down to improving our own, and your understanding of these machines that many hope, powered by renewable energy, will break down water to give us green hydrogen.

Electrolysers can range in size from small appliances to large-scale facilities and can be used for a variety of applications. While several types of electrolysers exist in the market today, there has been a rapid pace of innovation in Alkaline (AEL) and Proton Exchange Membrane (PEM) electrolyser technologies in recent years.

AEL Vs PEM

Alkaline and Proton Exchange Membrane (PEM) electrolyser technologies differ primarily in the type of electrolyte and the membrane used to separate the anode and cathode. In PEM electrolysis, a proton exchange membrane is employed to divide the anode and cathode, with an acidic electrolyte solution typically composed of dilute sulfuric acid. Conversely, alkaline electrolysis uses a basic electrolyte solution, commonly made of potassium hydroxide or sodium hydroxide.

These differences in electrolyte and membrane significantly impact the characteristics and applications of each technology. PEM electrolysis is favoured for producing high-purity hydrogen gas, while alkaline electrolysis is more suited for large-scale hydrogen production due to its ability to operate at higher current densities and lower cost. The materials and equipment for alkaline electrolysis are also generally less expensive compared to those used in PEM systems. However, the hydrogen produced via alkaline electrolysis tends to be of lower purity than that from PEM electrolysis. PEM electrolyser systems can achieve very high hydrogen purity (up to 99.999%), which is essential for applications like fuel cell vehicles.

Alkaline electrolysers also exhibit lower efficiency and slow response times to changing load demands as they struggle to adjust quickly to fluctuations in renewable energy sources, such as varying wind speeds and sunshine levels. Thus, the projects operate at low capacity. To compensate, these projects often require connections to the grid, thereby increasing costs and raising concerns about the carbon footprint of the hydrogen produced.

When it comes to hydrogen production using seawater, both PEM and alkaline electrolysis can be employed. However, PEM electrolysis is often preferred for this application because of its capability to produce high-purity hydrogen and operate at lower temperatures. In addition, PEM electrolysis can operate at lower temperatures than alkaline electrolysis, which can be an advantage in certain situations (for example, in warm climates).

Overall, PEM is generally considered a better alternative to the Alkaline option, especially for tapping the vast potential of hydrogen gas production from seawater.

Electrolysers: Global

The expansion of Fuel Cell Electric Vehicles (FCEVs) is being driven by global government initiatives, advancements in fuel cell technology, and improvements in infrastructure. As FCEV adoption increases, the demand for green hydrogen rises, highlighting the need for efficient and scalable PEM electrolysers. Governments in regions such as the US, European Union, and China are actively promoting this shift by offering incentives, subsidies, and favourable policies to encourage the widespread adoption of FCEVs. Currently, the market is dominated by alkaline electrolysers.

Market trends indicate that the global electrolyser market is still in its early stages, with manufacturing capacity concentrated in specific regions. In 2023, China accounted for about 60% of global capacity, followed by Europe at 20%, and the US at 16%. Even with upcoming capacity additions, most are expected to come from China, where the progress in green hydrogen is primarily driven by alkaline electrolysers.

In China, alkaline electrolysers hold nearly 93% of the market share. However, due to their disadvantages compared to PEM electrolysers, there is a growing shift toward the latter, although progress in PEM adoption has been slow due to factors like higher costs and limited reserves of necessary precious metals.

Globally, demand for PEM technology is increasing, prompting manufacturers to invest more in research and development. The PEM electrolyser market is highly regarded within the industry and is projected to grow at a compound annual growth rate (CAGR) of around 32.7% between 2024 and 2030. According to some estimates, total investment in China in PEM electrolysers and their components has exceeded 1 billion yuan ($140 million) since 2023.

More industrial players are entering this technology. In January 2024, BASF secured funding for a 54 MW proton exchange membrane electrolyser, expected to produce up to 8,000 metric tons of hydrogen annually, with the German Federal Ministry for Economic Affairs and Climate Action approving up to $143 million.

Leading companies in the electrolysers market include Thyssenkrupp nucera (Germany), John Cockerill (Belgium), Nel ASA (Norway), Plug Power Inc. (US), and Siemens Energy (Germany). Plug Power Inc. received a $21.8 million grant from the European Commission to build an offshore hydrogen production plant and will design and deliver a 10-megawatt (MW) PEM electrolyser system for the site in the North Sea. Cummins has also expanded its portfolio to include hydrogen technologies, such as PEM electrolysers.

The Asia Pacific region is expected to be the fastest-growing market for electrolysers. With a growing emphasis on efficiency, the market is ripe for PEM adoption to meet the region’s green hydrogen and green transportation goals.

Electolysers: India

India has recently seen a surge in domestic electrolyser manufacturing, with most developments focused on alkaline technology. Reliance signed an agreement with Nel ASA to source technology for electrolyser production. This agreement allows Reliance to manufacture Nel’s alkaline electrolysers for global captive purposes. Similarly, Adani New Industries is establishing an alkaline electrolyser facility using indigenous technology. Adani recently secured an order from SECI to set up an annual manufacturing capacity of 198.5 megawatts under the Production Linked Incentive Scheme for green hydrogen.

L&T Electrolysers operates a facility in Hazira, Gujarat, specialising in manufacturing pressurised alkaline electrolysers using technology from McPhy Energy, France. In March 2024, L&T commissioned India’s first indigenously built green hydrogen electrolyser at this plant. Greenzo Energy India, a green hydrogen solutions firm, also launched a 1 MW alkaline electrolyser plant.

In March 2024, Sterling Generators Private Limited (SGPL) and Técnicas Reunidas announced a memorandum of understanding (MoU) to develop a 1 megawatt (MW) green hydrogen electrolyser at SGPL’s Silvassa plant in India. The electrolyser is expected to be commissioned in late 2024, with potential scaling up to 10 MW.

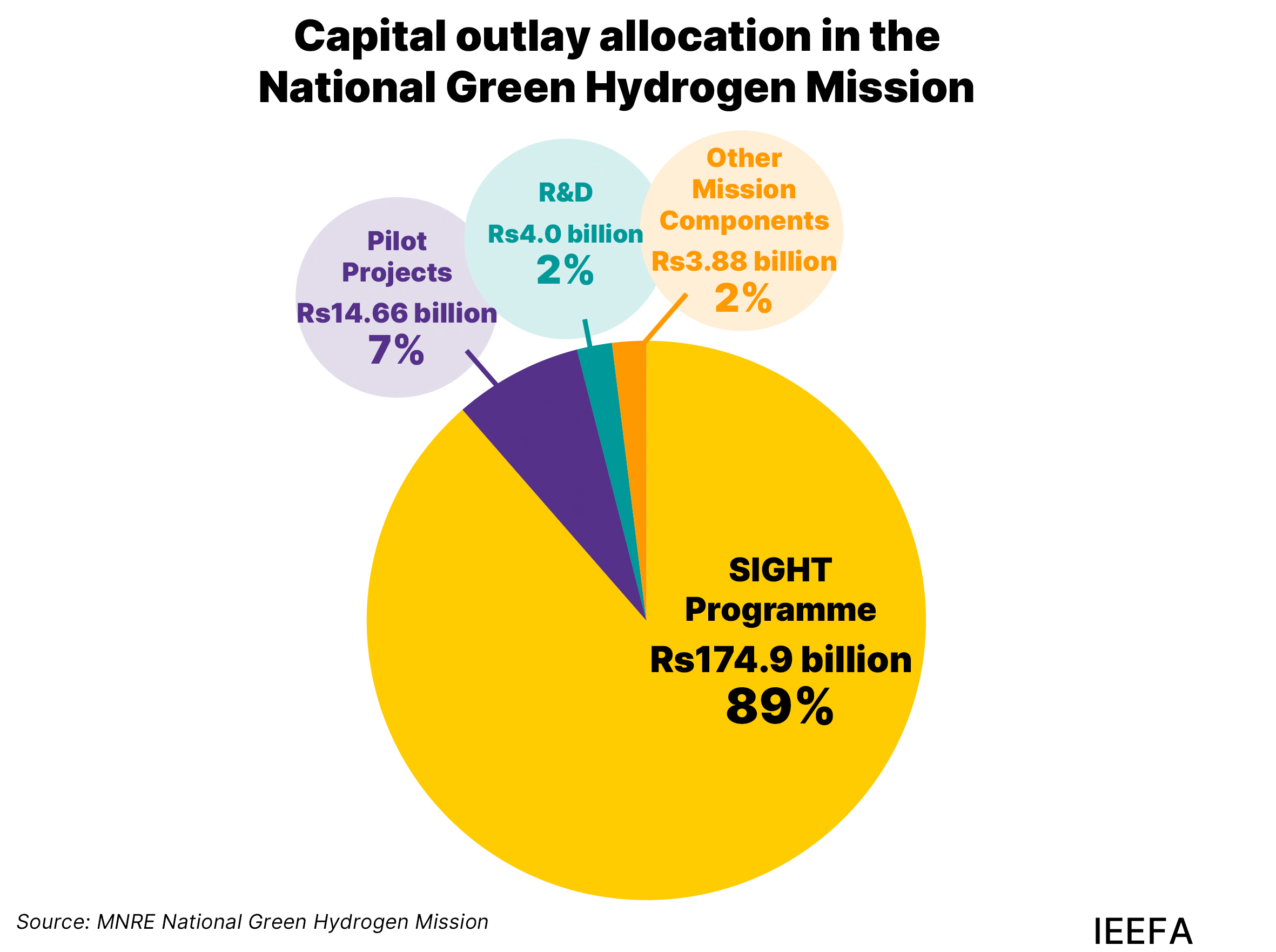

India’s $2.1 billion initiative to transform itself into a global green hydrogen powerhouse has received strong support from large strategic investors in the country’s private sector. However, a joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics suggests that the scheme could be further improved to attract start-ups and global players.

The Strategic Interventions for Green Hydrogen Transition (SIGHT) program offers INR 4.44 billion (US$541 million) in incentives for companies to establish 1,500 megawatts (MW) of electrolyser manufacturing capacity. SECI received bids exceeding this target, with a total of 3,328.5 MW from 21 bidders. Eight companies were successful, including Reliance Electrolyser Manufacturing, John Cockerill Green Hydrogen Solutions, and Jindal India, each securing 300 MW. The remaining capacity was awarded to Ohmium Operations, Advait Infratech, Larsen & Toubro, HomiHydrogen, and Adani New Industries.

Emerging Technologies Like PEM Set to Shape the Future of Electrolysis

Alkaline electrolysers currently dominate the global market. However, the advantages of PEM electrolyser technology, along with ongoing research and developments in other electrolyser technologies, have the potential to shift market dynamics in the coming years. Anion Exchange Membrane (AEM) and Solid Oxide electrolyser Cells (SOEC) are also gaining traction, with several companies advancing these technologies and some already seeing commercial deployments.

In January 2024, Enapter AG formed a joint venture with Wolong Electric Group Co., Ltd to acquire stacks from the Enapter Group and produce AEM electrolysers products in China. H2U Technologies has developed an iridium-free PEM electrolyzer in collaboration with CALTECH, leveraging AI-assisted data mining to synthesise, screen, and characterise multiple catalyst combinations. The Electric Hydrogen Company (EH2) has made significant strides with its breakthrough PEM electrolyser, featuring proprietary cell and stack designs that push power density to unprecedented levels, resulting in a compact, lower CAPEX unit.

The global electrolyser market has seen substantial growth, driven by the increasing focus on sustainable development and green energy initiatives. According to a report by the International Energy Agency (IEA), manufacturing capacity for electrolysers rose to approximately 23 GW per year by the end of 2023, up from just over 12 GW the previous year. Looking forward, commitments indicate that cumulative installed manufacturing capacity could reach nearly 170 GW by 2030, up from 102 GW announced at the end of 2022. Technological innovation will be key to the future of the electrolyser market, but much will depend on the adoption of these emerging technologies.