The transition to renewable energy is not just a technological shift; it’s a complex interplay of policies, market dynamics, and societal acceptance. As the world grapples with climate change, energy security, and economic resilience, governments are increasingly recognizing the need to enhance their renewable energy strategies. This blog outlines key policy trends driving renewable energy deployment while also addressing existing challenges for achieving global climate goals by 2030.

The International Energy Agency has released Renewables 2024 report: Analysis and forecasts to 2030, which in addition to other highlights also gives an account of key policy trends driving the renewable energy deployment across the globe. Notably, the climate and energy security policies in nearly 140 countries have played a crucial role in making renewables cost-competitive with fossil-fired power plants.

The Global Context

In December 2023, during the COP28 UN Climate Change Conference, nearly 200 countries committed to tripling the world’s installed renewable energy capacity by 2030. This ambitious goal reflects a growing recognition of the role renewables play in achieving climate targets and ensuring energy security.

According to IEA, global renewable capacity is projected to grow by 2.7 times by 2030, surpassing current government ambitions by nearly 25 percent but still falling short of the tripling target set at COP28.

Considering existing policies and market conditions, IEA forecasts 5,500 gigawatts (GW) of new renewable capacity to become operational by 2030. This will also result in global renewable capacity additions reaching almost 940 GW annually by 2030 – 70 percent more than the record level achieved last year.

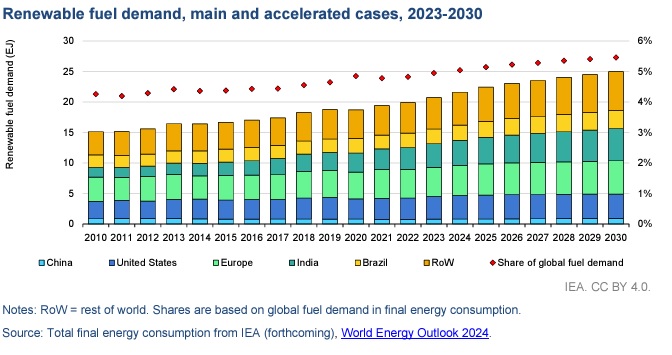

The report also notes that the potential for long-term growth in renewable fuel use is significant. In the IEA Net Zero Emissions by 2050 Scenario, renewable fuel deployment would need to more than double by 2030 from 2023 levels, and then double again by 2050. However, despite their relative importance and increasing policy interest, none of the renewable fuels are on track with the Net Zero by 2050 Scenario.

Policy Trends Driving Renewable Energy Deployment

Here are key policy trends that are driving RE deployment globally.

Competitive Auctions

Countries like India and the European Union (EU) have embraced competitive auctions to stimulate renewable energy growth, particularly in solar and wind sectors. These auctions allow governments and agencies to procure renewable energy at the lowest possible cost by inviting companies to bid for renewable energy projects.

The competitive nature drives down prices while ensuring that a significant amount of renewable energy capacity is added. For instance, in India, aggressive auction strategies have helped secure solar and wind energy at some of the lowest global costs, making renewables increasingly attractive for developers and investors.

Tax Credits and Financial Incentives

In the United States, the Inflation Reduction Act (IRA) has been a game-changer for renewable energy deployment. It provides long-term tax credits for clean energy projects, including solar and wind farms, which help reduce upfront capital costs. The IRA supports renewable energy growth through incentives that make it more financially viable for companies to invest in renewable infrastructure. Notably, IRA is offering up to 50 percent in investment tax credits for new renewable energy installations, which has stimulated rapid growth. By 2024, the United States is expected to experience significant construction in renewable energy sectors as these incentives continue to attract investments

Similar incentives are also seen in other regions, such as Canada and parts of Europe, where financial mechanisms such as CAPEX investment grants are used to lower the risks associated with high initial investments in clean energy projects.

Mandates and Blending Targets

India is leading the way with ambitious blending targets for biofuels and biogases. Policies like the National Policy on Biofuels and blending mandates require a certain percentage of biofuels in transportation fuel. For example, India has set blending targets to ensure that a significant portion of its energy needs, particularly in the transportation sector, is met through renewable biofuels. These mandates, coupled with production incentives, are expected to boost renewable fuel consumption by nearly 40 percent by 2030, helping India reduce its reliance on fossil fuels and promote domestic biofuel production.

Brazil has similar mandates for biofuel blending, with an expected rise in biofuel use by 15 billion litres by 2030, achieving a 45 percent blending rate.

Hydrogen Projects

Hydrogen can serve as a versatile energy carrier, and with increasing support from global governments, it is poised to play a pivotal role in future energy systems. These hydrogen projects not only promote energy diversification but also align with global efforts to reduce carbon emissions in sectors where direct electrification is challenging.

Countries such as Brazil are actively developing green hydrogen projects as part of their renewable energy strategies. Brazil has announced a USD 3.2 billion incentive program for green hydrogen, a renewable energy source that can decarbonize hard-to-electrify sectors like heavy industry and transportation.

By 2030, the EU aims to meet 1 percent of its Renewable Fuel of Non-Biological Origin (RFNBO) targets using renewable hydrogen. Similarly, the U.S. is expanding its hydrogen capacity, with projections of 50 PJ of renewable hydrogen demand by 2030 .

Grid Integration and Flexibility

As the share of variable renewable energy (VRE) like solar and wind increases, managing grid stability and curtailment becomes crucial. Countries like Germany, Chile, and the UK are working to improve grid integration by implementing policies focused on flexibility. These include grid infrastructure upgrades, battery storage deployment, and demand-response measures. Such policies aim to reduce curtailment—the reduction of power generation from renewable sources due to grid constraints—and ensure that renewable electricity is efficiently absorbed into the system.

In markets with high VRE penetration, like Germany and Chile, curtailment rates have recently reached 5 percent to 15 percent, highlighting the importance of flexibility in renewable energy policy frameworks. In Europe, long grid queues and inadequate network capacity are causing delays, but reforms such as the European Commission’s grid action plan aim to reduce project lead times. Germany, for instance, increased wind energy permit grants by 70 percent from 2022 to 2023.

Supportive Policies in Major Economies

Notably, the energy demand is expanding in all regions, but is concentrated in India, China, Brazil, the United States and Europe, which collectively support more than two-thirds of the growth. All five regions have dedicated support policies for several – and in some cases all – renewable fuels. The support policies vary by fuel, sector and country, but often include a combination of mandates, GHG performance criteria and direct production and CAPEX investment incentives.

For instance, India provides investment and production incentives for liquid biofuels, biogases, solid biomass and hydrogen, as well as blending targets for biofuels and biogases, boosting renewable fuel use by nearly 40 percent to 2030 from 2023 levels. In Brazil, which is responsible for 12 percent of growth, there is new demand for liquid biofuels owing to planned increases to biofuel blending targets. Brazil has also announced a USD 3.2-billion green hydrogen incentive programme.

Meanwhile, renewable fuel use expands in all sectors in China (3 percent of the global growth), buoyed by biogas and solid biomass deployment in industry and for building heat; renewed interest in biodiesel blending; and hydrogen use in the transport and industry sectors. Competitive auctions and corporate power purchase agreements are driving expansion in the European Union, with specific targets for solar PV and wind.

Addressing Barriers to Growth

Despite these positive trends, several barriers still hinder faster deployment of renewables:

- Financing Challenges: High financing costs continue to be a major obstacle, particularly in emerging economies with limited access to capital. The report highlights that these high costs undermine the economic appeal of renewable energy in many developing regions. To address this, policymakers must establish stable environments with clear long-term goals to lower investment risks and attract more funding.

- Grid Infrastructure Limitations: As renewable penetration increases, so does the need for robust grid infrastructure capable of handling variable generation sources like solar and wind. Investment in grid upgrades is lagging behind deployment rates. IEA suggests that governments must prioritise grid modernization initiatives to accommodate growing renewables. Currently, at least 1,650 GW of renewable capacity is in advanced stages of development but waiting for grid connection—an increase of 150 GW from last year.

- Policy Inconsistencies: Frequent changes in government policies may create uncertainty for investors. A stable policy framework with long-term commitments is essential for fostering confidence among stakeholders.

The path towards a sustainable energy future is paved with policy decisions that can either accelerate or hinder progress. As countries strive to meet ambitious climate targets set at COP28, it is imperative that they adopt comprehensive policies that not only promote renewable technologies but also address existing barriers to growth. By fostering an environment conducive to innovation and investment in renewables, nations can ensure a reliable, affordable, and sustainable energy future for all.