The renewable energy industry has been on a transformative journey over the past few decades. At the heart of this revolution lies large-scale battery storage which is considered to be one of the most critical technological advancements. These batteries have evolved from small, short-duration systems to massive, long-duration powerhouses that are now integral to the global energy grid. These batteries will play a vital role in enabling the grid to handle the higher share of renewable energy, especially intermittent solar and wind energy.

We look at the evolution of large batteries, exploring how they started, how far they’ve come in terms of duration and technology, the cost trends that have shaped their development.

The Early Days of Large Batteries

Large batteries have been around for several decades, but their initial applications were limited and somewhat rudimentary. The first large-scale batteries were primarily lead-acid batteries, a technology that dates back to the mid-19th century. These batteries were used in various industrial applications, but their use in energy storage was limited due to their low energy density, short lifespan, and high maintenance requirements.

The real turning point for large batteries came in the 1990s with the development of lithium-ion (Li-ion) technology. Lithium-ion batteries offered several advantages over their lead-acid counterparts, including higher energy density, longer lifespan, and lower maintenance. The first commercial lithium-ion batteries were introduced by Sony in 1991, and they quickly became the standard for portable electronics like laptops and mobile phones.

However, it wasn’t until the early 2000s that lithium-ion batteries started being used in larger applications, such as electric vehicles (EVs) and grid-scale energy storage. By 2023, battery storage in the power sector became the fastest-growing commercially available energy technology, with deployment more than doubling year-on-year.

The surge in battery demand has heightened reliance on critical minerals, with China processing over half of global lithium and cobalt and holding nearly 85 percent of battery cell production, while Europe, the U.S., and Korea each manage less than 10 percent of the supply chain.

From Minutes to Hours

One of the most critical factors in the effectiveness of battery energy storage is duration—the length of time a battery can discharge energy. Early utility-scale batteries, like the Hornsdale Power Reserve in South Australia (commissioned in 2017), offered storage durations of around one hour. These batteries were primarily used for grid stabilization, frequency regulation, and short-term peak shaving. Made by Tesla in record time as a demonstrator, the battery has more than justified its promise so far by providing back up storage and grid support at critical times.

As the renewable energy industry matured, the demand for longer-duration storage grew. In 2024, batteries capable of 4-hour and even 8-hour durations have set the new bar for battery energy storage industry. This shift is driven by the need to store larger quantities of energy for extended periods, particularly as the penetration of intermittent renewable sources like wind and solar increased.

Globally, a significant expansion has been seen in the deployment of long-duration batteries. For instance, in California, long-duration batteries have started to play a pivotal role in grid management. The Moss Landing Energy Storage Facility, for example, boasts a capacity of 400 MW/1,600 MWh, offering 4-hour storage and helping to stabilize the grid during peak demand periods.

In Australia, the RWE Limondale battery—a 50 MW / 400 MWh system with 8-hour storage—was the surprise winner of the first long-duration energy storage tender in New South Wales. Similarly, Ark Energy’s Myrtle Creek project, set to be the world’s largest 8-hour battery at 275 MW/2,200 MWh, highlights the rapid evolution of storage durations. Keep in mind that in evey case, the batteries are powered primarily by renewable energy.

This trend toward longer durations is not just limited to Australia or the United States. Europe is also seeing significant growth in long-duration battery projects. In the UK, the Minety Battery Storage Project, with its 100 MW/100 MWh capacity, has been pivotal in supporting the grid and integrating renewable energy sources.

From Lead-Acid to Lithium-Ion and Beyond

Lead-acid batteries are bulky, have a low energy density, and require regular maintenance. They also have a relatively short lifespan, typically lasting only a few hundred charge-discharge cycles.

The introduction of lithium-ion technology in the 1990s was a game-changer. Lithium-ion batteries have a much higher energy density, allowing them to store more energy in a smaller and lighter package. They also have a longer lifespan, with some batteries lasting thousands of charge-discharge cycles. That’s not all, lithium-ion batteries require little to no maintenance, making them ideal for a wide range of applications.

The development of lithium-ion technology has continued to advance over the years. Modern lithium-ion batteries are more efficient, with higher energy densities and longer lifespans than ever before. They are also safer, thanks to improvements in battery management systems (BMS) and the development of new materials such as thermal insulating ceramics, flame retardants, non-flammable electrolytes, and advanced polymer-based or composite separators, alongside improved cooling solutions like heat pipes and liquid cooling systems that reduce the risk of overheating and thermal runaway.

One of the most exciting developments in battery technology in recent years is the advent of solid-state batteries. Unlike traditional lithium-ion batteries, which use a liquid electrolyte, solid-state batteries use a solid electrolyte. This offers several advantages, including higher energy density, improved safety, and longer lifespan. While solid-state batteries are still in the early stages of development, they have the potential to revolutionize the energy storage industry in the coming years. Except that unlike so many of the promises we have seen in the space, solid state batteries actually look like they might make a serious appearance in 2025 itself.

Another promising technology is flow batteries, which store energy in liquid electrolytes contained in external tanks. Flow batteries offer the potential for extremely long-duration storage, as their capacity is determined by the size of the electrolyte tanks. This makes them ideal for applications where large amounts of energy need to be stored for extended periods, such as grid-scale energy storage.

From Expensive to Economical

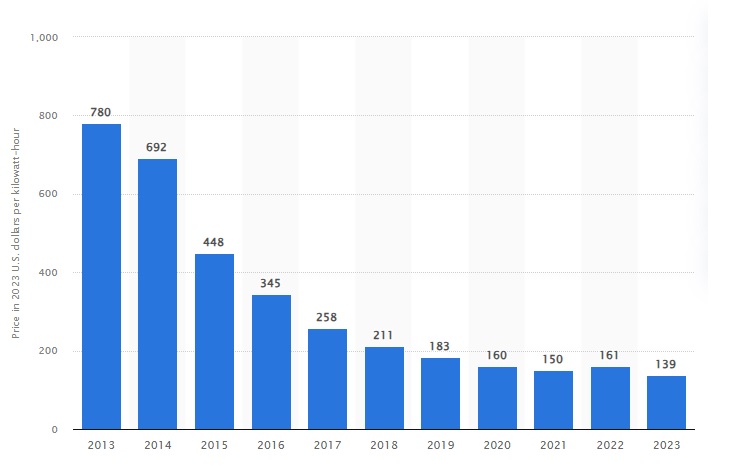

The cost of large batteries has been one of the biggest barriers to their widespread adoption. In the early days of lithium-ion technology, batteries were expensive, with costs as high as USD 1,000 per kWh in the late 2000s. This made them viable only for high-value applications, such as portable electronics and luxury electric vehicles.

However, over the past decade, the cost of lithium-ion batteries has plummeted, driven by economies of scale, advancements in manufacturing processes, and increased competition.

By 2024, the cost of lithium-ion batteries had fallen to around USD 100 per kWh or lower, making them increasingly competitive with traditional energy storage technologies like pumped hydro and natural gas peaker plants.

This dramatic cost reduction has been a major factor in the rapid growth of the energy storage industry. As batteries have become more affordable, they have become an increasingly attractive option for a wide range of applications, from residential solar-plus-storage systems to utility-scale energy storage projects.

The cost trend for large batteries is expected to continue downward in the coming years. Analysts predict that the cost of lithium-ion batteries could fall below USD 80 per kWh by 2030, thanks to ongoing improvements in battery chemistry, manufacturing processes, and supply chain efficiencies. This will further drive the adoption of battery storage, making it an even more integral part of the global energy landscape.

While lithium-ion batteries have dominated the energy storage market, the cost of other emerging technologies, such as solid-state batteries and flow batteries, is also expected to decrease as they move from the research and development phase to commercial deployment. This will further diversify the energy storage market and provide more options for different applications.

The Global Shift

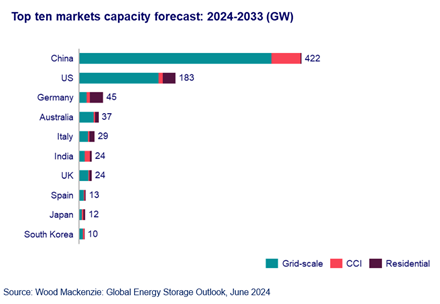

The adoption of large batteries has surged in recent years, driven by the falling cost of batteries, the increasing need for grid stability, and the growing penetration of renewable energy sources like wind and solar. The trend is expected to continue and even accelerate in the years to come. According to the latest forecast from Wood Mackenzie’s Global Energy Storage Outlook, the global energy storage market (excluding pumped hydro) is on track to reach 159 GW/358 GWh by the of 2024 and grow by about than 636% by 2033, with nearly over 926 GW/2,789 GW of new capacity expected to come online.

Historically, the United States has been a leader in the adoption of large batteries, thanks in part to favorable policies and a strong market for renewable energy. California, in particular, has been at the forefront of the energy storage revolution, with the state mandating that utilities procure a certain amount of energy storage to support the grid. This has led to the development of some of the largest battery projects in the world, including the Moss Landing Energy Storage Facility and the Alamitos Energy Center.

Europe has also seen significant growth in the adoption of large batteries. The European Union’s ambitious climate goals and the increasing share of renewable energy in the grid have driven demand for energy storage solutions. Germany, the UK, and Spain are among the leading countries in Europe for battery storage deployment. The European market is expected to continue growing, with the EU’s Green Deal and other initiatives providing strong support for energy storage.

Australia, as previously mentioned, has also been a significant adopter of large batteries, driven by the need to stabilize a grid that is increasingly reliant on renewable energy. The country has seen a series of groundbreaking battery projects, including the Hornsdale Power Reserve and the upcoming Myrtle Creek project.

In Asia, China has expectedly emerged as a major player in the energy storage market, thanks to the record amounts of renewable energy it is adding to the grid every year The Chinese government has set aggressive targets for renewable energy and energy storage, leading to a rapid increase in the deployment of large batteries. China is now the world’s largest market for energy storage, with the country expected to account for more than 50 percent of global battery storage capacity by 2025. Due to its booming solar market, the Asian country is poised to average an energy storage deployment of 42 GW/120 GWh annually in the next 10 years.

India’s Ascent Amidst China’s Dominance

While China dominates the global stage in energy storage, India is quietly but rapidly emerging as a contender in the race. As of March 2024, India’s BESS capacity reached 219.1 MWh, reflecting significant growth in the sector. Since 2013, when India began with small pilot projects, the country has expanded its energy storage capacity, with 120 MWh (40 MW) added in just the first quarter of 2024. Solar photovoltaic (PV) and battery energy storage systems accounted for 90.6 percent of the total installed capacity.

Chhattisgarh led the way with the highest BESS capacity, holding 54.8 percent of the cumulative installed capacity as of March 2024. Rajasthan is also making strides, with the largest standalone BESS capacity currently under development, driven by favorable state policies and energy storage obligations.

To further boost its energy storage capabilities, India has implemented INR 37.6 billion (approximately USD 452 million) Viability Gap Funding program aimed at installing 4 GWh of BESS by the financial year 2026. This initiative, along with energy storage obligations and bidding guidelines, is expected to significantly advance India’s energy storage project pipeline.

The rate of adoption of large batteries is expected to continue accelerating in the coming years. As more countries set ambitious renewable energy targets and phase out fossil fuel generation, the need for energy storage will only grow.